May 28, 2021

Tax Tips: Which Documents to Destroy This Tax Season

The natural tendency when filing taxes is to hold on to every piece of documentation just in case you need it in the future. Everyone fears IRS audits, which can take place at any time. Whether you’re dealing with business taxes or personal taxes, Proshred® Dallas Fort Worth has information to help you know which documents to hang on to, and when you can let them go.

Can you destroy tax documents?

The rules are a bit tricky about which documents you can destroy and when you can destroy them. These rules are also very specific. For instance, if you file your tax returns properly and on time, under current law, you must keep your tax documents for three years from the date you filed, or two years from the date you paid the tax, whichever date is later.

However, there is a massive push by the IRS to extend the limit to six years, so many CPAs and tax advisors recommend keeping your tax documents a minimum of six years before hosting your own private financial record shredding party.

When it comes to tax documents concerning stocks, bonds, and IRAs, you should hold on to investment documentation as long as you maintain the investments, and for three years after filing relevant tax returns after divesting the investments. Some advisors may recommend holding on to them for six years for added security.

A word of warning, though: if you neglected to file, there is no statute of limitations. Even if you have a valid reason for failing to file, you must retain documentation. Having the appropriate documentation may prove invaluable in heading off a major audit for the tax year(s) in question. Valid excuses may include:

- Returning to school.

- Caring for a sick relative.

- Family leave.

While these are the guidelines for which personal tax documents you can get rid of and when, the rules for businesses are a little different.

Are requirements different for business taxes

The IRS recommends businesses hang onto business tax records for at least three years, though accountants will often advise holding onto these documents for at least seven years. The IRS also recommends employers maintain employee records for three years after the employment is terminated. However, they require employers to maintain employee earnings records for at least four years, though many employers are encouraged to keep documents up to seven years in case questions arise.

Other documents businesses might want to hang onto for extended periods of time include:

- Employment tax records– Keep four years after the date they were due or paid (whichever was longer).

- Travel and entertainment– Keep records for expenses and receipts for three years.

- Sales tax returns– In Texas, businesses must keep sales tax records for at least four years.

Fortunately, we live in a largely digital age, and as long as your system meets IRS standards, you can now store your tax records digitally, which greatly reduces the costs of losing important data and reducing the costs of maintaining your records. For this purpose, Proshred® now offers scanning services so that you can store and organize old records using a secure, convenient digital document management system. However, when you purchase new computers, you should schedule a hard drive shredding service to properly destroy the data stored on your devices after it has been transferred to a new storage device.

How to Safely Destroy Documents

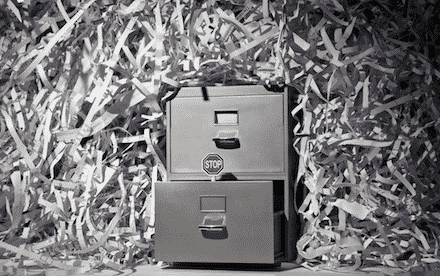

Once you digitize documents or files have reached their end of life, you must safely discard the outdated materials. With identity theft becoming such a massive problem, it is more important than ever to safeguard your information.

If you live in Dallas Fort Worth, Texas, you have one great paper shredding option available to you. Proshred® Dallas Fort Worth offers secure mobile shredding services so you can eliminate unnecessary paper waste while ensuring your documents are securely destroyed. Our full-service document management program includes not only paper shredding, but digital scanning, hard drive and media destruction, and product destruction. Anything you need shredded, we’ve got you covered! Call today to schedule your appointment. 469-930-6044